Direct deposit enrollment forms offer a multitude of advantages for both payers and recipients. These forms serve as written permission from an individual to authorize payments to be sent directly into their bank account, eliminating the need for physical checks and providing a seamless transfer process.

By understanding the key elements, benefits, and tips for successful direct deposit enrollment, individuals can make the most of this convenient payment method.

What is a Direct Deposit Enrollment Form?

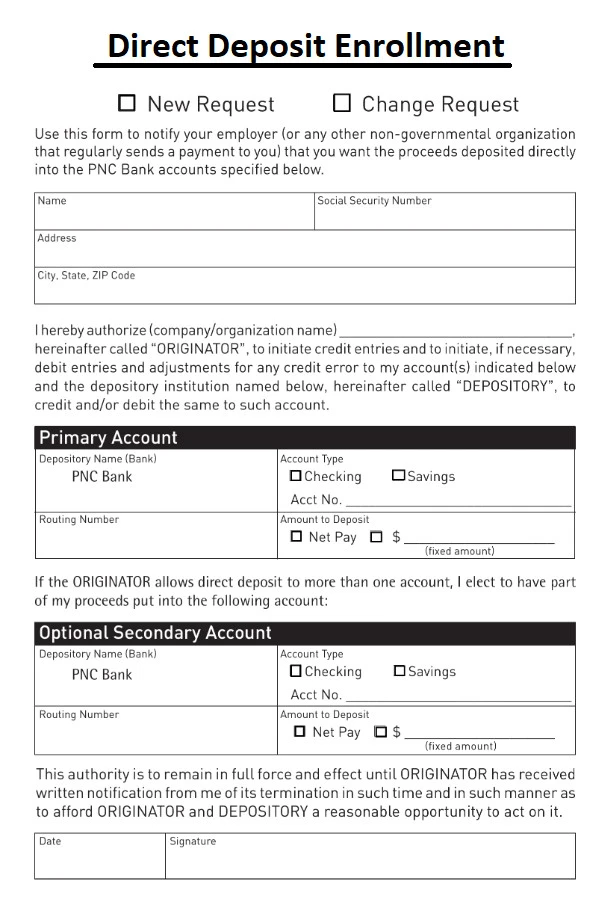

A direct deposit enrollment form is a document that allows individuals to provide their bank account information to a payer, permitting payments to be electronically deposited into their account.

This form serves as a convenient and secure way to receive funds without the hassle of paper checks.

Why Use Direct Deposit Enrollment Forms?

Security

One of the primary reasons to utilize direct deposit enrollment forms is security. With electronic transfers, there is no risk of lost or stolen checks, reducing the likelihood of fraudulent activity and ensuring that funds are delivered safely.

Convenience

Direct deposit offers unparalleled convenience for both payers and recipients. Funds are automatically deposited into the individual’s bank account, eliminating the need to visit a bank or wait for checks to clear. This convenience saves time and simplifies the payment process.

Timeliness

Direct deposit ensures that payments are received on time, every time. By setting up electronic transfers through a direct deposit enrollment form, individuals can avoid delays in receiving funds and have peace of mind knowing that payments will be delivered promptly.

Key Elements of a Direct Deposit Enrollment Form

Bank Account Information

The bank account information provided on a direct deposit enrollment form is crucial for ensuring that funds are transferred accurately. This information includes the individual’s account number and routing number, which are essential for initiating electronic transfers.

Personal Information

Personal information such as the individual’s name, address, and contact information is required on a direct deposit enrollment form to verify their identity and ensure that payments are sent to the correct recipient.

Authorization Signature

By signing and dating the direct deposit enrollment form, the individual provides explicit consent for payments to be electronically deposited into their bank account. This authorization signature is a legal requirement for processing electronic transfers.

Payer Information

The direct deposit enrollment form may also request information about the entity making the payments, such as the payer’s name, contact information, and any additional details necessary for processing the transfers. This information helps ensure that payments are sent from a verified source.

How to Complete a Direct Deposit Enrollment Form

Obtaining the Form

Start by obtaining a direct deposit enrollment form from the payer, employer, or financial institution. Many organizations provide these forms online for easy access.

Filling Out the Form

Complete all sections of the direct deposit enrollment form accurately and legibly. Double-check the information provided to ensure that there are no errors that could delay the processing of payments.

Signing and Dating

Be sure to sign and date the direct deposit enrollment form to authorize electronic transfers. Without a valid signature, the form may not be accepted, and payments may not be processed.

Submitting the Form

Submit the completed direct deposit enrollment form to the payer or organization according to their instructions. Some may require the form to be submitted in person, while others may accept electronic submissions.

Tips for Successful Direct Deposit Enrollment

Double-Check Information

Before submitting the direct deposit enrollment form, double-check all information provided to ensure its accuracy. Any errors could result in delays in processing payments.

Keep a Copy

Make a copy of the completed direct deposit enrollment form for your records. This copy can be used as a reference if any issues arise with the electronic transfers.

Follow Up

After submitting the direct deposit enrollment form, follow up with the payer to confirm that the electronic transfers have been set up successfully. Inquire about the expected timeline for receiving payments.

Update Information

Inform the payer promptly of any changes to your bank account or personal information. Keeping this information up to date will help avoid disruptions in payment processing.

Direct Deposit Enrollment Form – DOWNLOAD